5 deal risks that lead to revenue leak and how to fix them

Table of Contents:

Does your sales or customer success team find it challenging to manage multiple deals at once? Are deals often slipping through the cracks? The ability to recognize and manage deal risks can make a significant difference to your sales close rate and customer account expansions.

In this article, we will be discussing five common deal risks that sales and customer success teams should be aware of and how to mitigate them.

Recognizing these deal risks in time will ensure you’re not dropping the ball on any deal in your pipeline, whether it's closing new deals or seeking expansion opportunities. You might just find the key to increasing your sales success rate and boosting your customer retention.

What is a deal risk?

Deal risks are potential threats or challenges that can negatively affect the progress or success of a deal. They arise due to various factors, such as changes in the customer's circumstances, buyer experience, competition, or internal process issues in your sales or customer success such as not not establishing enough connections in the prospect’s organization, not following up on time, and more.

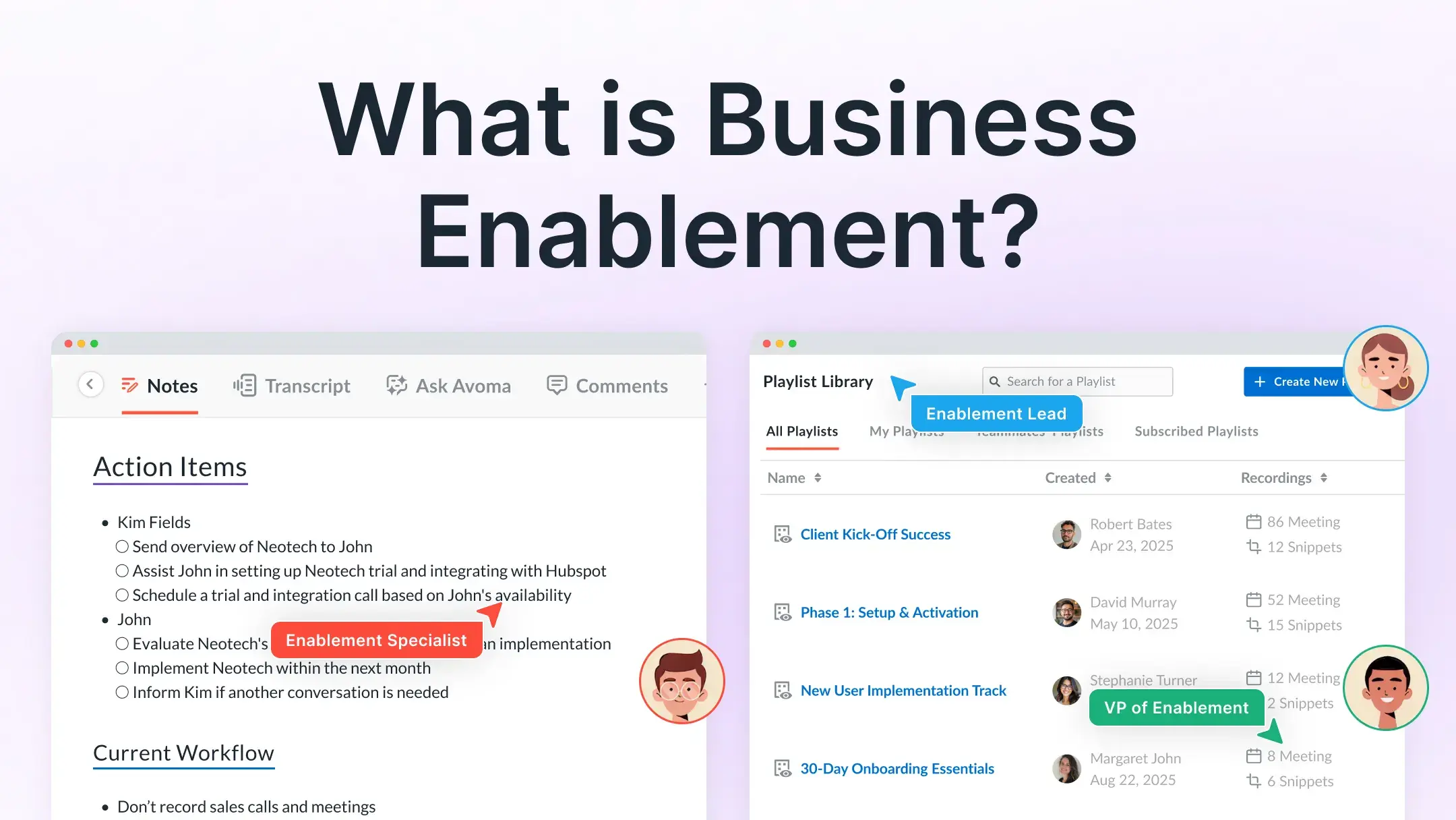

Recognizing these risks early can help you take proactive measures to address them, thereby boosting your chances of closing the deal. At Avoma, we categorize deal risks as well as the factors that are going well with a given deal, as Deal Health.

The first step in identifying deal risks is to understand the deals in your pipeline. This involves evaluating each deal in terms of its stage, size, and importance. You need to keep tabs on the customer's needs, priorities, and decision-making process.

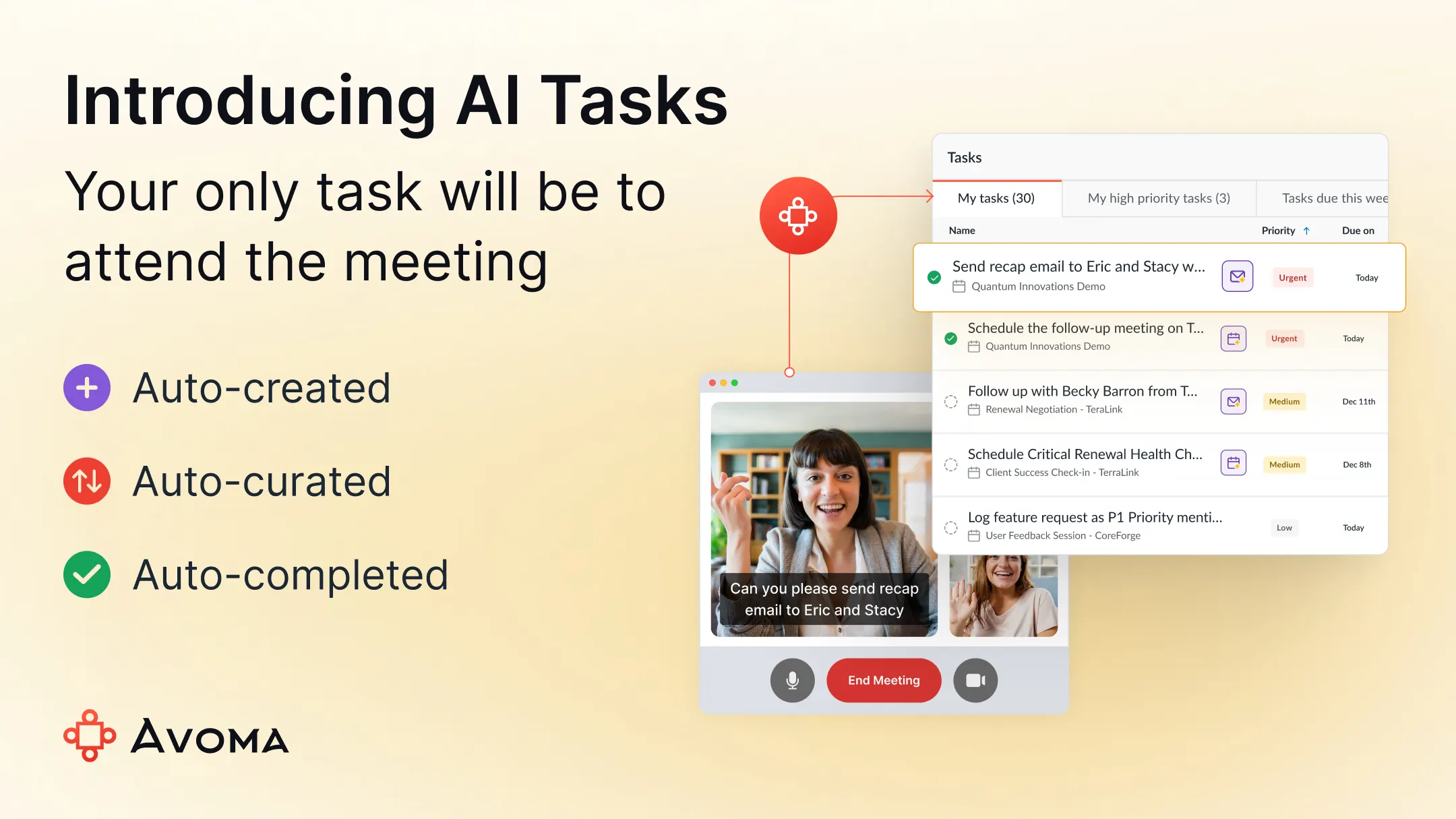

The way Avoma does it is by tracking the movements impacting the health of deals and alerting sales and customer success teams on time so that no deal slips through the cracks. These alerts help you you to pre-empt potential obstacles and devise a strategy to overcome them.

Alright, with that, let’s now look at the top five deal risks that you need to track.

Deal Risk 1: Single Threading

One of the major deal risks is having only one stakeholder involved from the prospect account. Having a single stakeholder in a deal is akin to putting all your eggs in one basket. If that individual decides to withdraw or changes their points of view, your deal could crash and burn.

It underscores that the health of a deal could depend heavily on the whim of a single individual, making the whole process potentially unstable and uncertain.

On the other hand, having multiple stakeholders considerably reduces this risk. Diversifying stakeholders also presents another advantage: it allows for a diversity of perspectives. Each stakeholder involved brings to the table their unique insights, angles, and expertise to the deal. This diversity can lead to a more robust, resilient, and innovative deal structure.

Single stakeholder reliance is, thus, a deal risk that must be managed and mitigated. As part of the deal health score

Therefore, if you wish not to let deals slip from your hands, one should aim to involve multiple stakeholders. Diversity is not just about sharing risks; it's about developing diverse strategies, robust resilience and ensuring the deal's overall health.

Deal Risk 2: Account activity

Another key indicator that a deal may be at risk is lack of regular communication be it over email, zoom meeting or on social media.

Reminders and follow-ups should be part of your communication workflow. Regular check-ins with the other party not only keep the conversation going, but also demonstrate your commitment to the deal and your professionalism.

If it has been more than 15 days since the last exchange, it could be a sign that the deal is not progressing as planned.

This could be due to a number of reasons, including a lack of commitment from the other party, external factors impacting deal progression, or a simple lack of communication.

In short, if you don’t have the next meeting scheduled, it means you don’t really have a deal. So, you need to track when last a substantial and meaningful interaction occurred.

Therefore, actively managing and tracking the communication flow for every deal is critical to its success.

This is where Avoma makes it super easy for you. Avoma tracks all the deals in your pipeline and alerts you on those of your deals where there hasn’t been an email or call or a meeting for a while.

It helps you take action in time so that you don’t drop the ball on any deal. Based on the Deal Health Alerts, your action could be as simple as a message to discuss progress, an email to clarify a point, or a call to strategize the next steps. Sometimes, it can even give you signals to reconsider the viability of the deal.

The purpose of these alerts iso maintain open lines of communication and ensure that both parties are on the same page about the status of the deal and the steps needed to move it forward.

All said, it’s about striking the right communication balance. Consistent communication doesn't mean bombarding the other party with messages.

It means meaningful and purposeful conversations that contribute to the progression of the deal. This helps to keep everyone engaged, aligned and invested in the successful conclusion of the deal.

Deal Risk 3: The sentiment of the latest customer email

Modern sales is primarily about offering a great buyer experience, which typically involved demo conversations and email follow ups. The sentiment expressed in these emails can be a significant indicator of the prospect's satisfaction and their intent to continue with the deal.

If the latest email from a prospect or customer carries a negative tone, it could be a significant risk to the deal. This risk is even more alarming if it's not just one email, but a series of emails, that carry a negative sentiment.

Negative sentiments are a clear sign that something is not right and that immediate attention is required. Ignoring such signs or failing to address the underlying issues could lead to losing deals or leaving potential revenue on the table.

A negative sentiment in a customer email could stem from a variety of issues. It could be dissatisfaction with the product or service, displeasure with the sales experience or quality of customer service, or miscommunication between the business and the customer.

Whatever the cause, a negative sentiment in a customer email is a clear warning sign that the deal could be in jeopardy. It suggests that the customer is unhappy and might consider pulling out of the deal unless the issues they're facing are addressed.

While it’s a significant risk, the worst thing is not realizing the potential risk and not taking action on time.

A negative sentiment in a customer email is also an opportunity. It's an opportunity for you to step up, address the customer's concerns, and turn the situation around.

Therefore you need to be proactive in identifying this. This is another Deal Health Alert that Avoma offers where it reads into the sentiment of your last conversation and nudges you to improve the customer experience proactively.

If you can successfully address the issues raised in the email and turn the customer's sentiment around, it could not only save the deal but also strengthen your relationship with the customer, leading to more opportunities, expansions, and referrals in the future.

Deal Risk 4: Zero Positive Moments

Every successful SaaS deal hinges on a series of positive interactions and experiences that keep both parties invested and confident in the ongoing relationship.

However, there's a significant risk that presents when these positive moments are noticeably absent from your deal conversations. This can be a clear red flag, signaling problems in building rapport, setting the right expectations, and the overall deal progression.

Positive moments in a deal isn’t confined to the instances where your product precisely meets the needs and pain points of your prospect. Also it doesn’t mean the prospect won’t have objections.

Positive moments are moments during a conversations where prospect shows interest and probably also suggests ways to make the deal work.

Here’s an example of a positive moment where the prospect shares that trying out the starter plan of Avoma could help them gain confidence in committing for a bigger deal.

These moments validate the customer's decision to engage with your company and also provide them with the reassurance that they're making the right business choice.

If your deal conversations are devoid of these positive moments, it could indicate one of the following:

- The discovery and demo experience wasn’t great

- Your value proposition isn't resonating with the prospect

- There's a lack of understanding or alignment between both parties

- Your product or service doesn't meet their expectations

So, it’s important to consider the presence of Positive Moments when doing your periodic deal reviews. Avoma gives you an alert to notify the deals that don’t have any positive moments, so that work towards mitigating the risk with them.

Contingency planning for this risk should revolve around enhancing prospect engagement, understanding their priorities, and solution alignment, all critical aspects that can greatly influence the outcome of your deals.

Deal Risk 5: The close date has passed or changed

In business transactions, a deal close date is typically established to create a timeline for completion and to ensure all parties are on the same page regarding expectations. This date is a signal to all stakeholders that the contract needs to be signed by then. However, when this deal close date passes without any closure, it may indicate that the deal is stalling, which is a significant risk to consider.

There can be multiple reasons why a deal might stall after its closing date. This could be due to unforeseen challenges, such as legal issues, financing problems, or disagreement over terms and conditions.

Alternatively, it could be a sign of a lack of commitment or interest from either party, signaling red flags that could jeopardize the deal's successful closure.

A stalled deal can have severe consequences. It may result in wasted resources, such as time and money spent on negotiations and preparations. Moreover, it could damage the relationships between involved parties and even tarnish reputations, depending on the circumstances.

It also means that the resources tied up in this stalled deal could have been better utilized in other potential opportunities. Therefore, the opportunity cost becomes a significant factor to consider.

To mitigate this risk, it is crucial to track deal progress with all the four factors discussed above, so that you don’t pass the deal date. In some cases, extending the deadline or considering alternative solutions might be the best course of action.

But that said, frequent change of close date is a definitely a sign of deal being at risk. Tracking the changes to close date on a regular basis is key.

If there are signs of a delay, it may be beneficial to revisit the deal's key points and resolve any outstanding issues. Above all, it is essential to take a proactive approach to identify and manage this risk timely and effectively.

Summing up…

It's essential that sales and customer success teams are aware of the various deal risks that can negatively impact their sales success. By recognizing these risks early and taking proactive measures to mitigate them, you can prevent deals from slipping through the cracks.

While the core intention of identifying and tackling potential deal risks is preventing potential revenue leaks, it also leads to improving the overall effectiveness of your sales and customer success process.

This will not only increase your chances of closing deals but also boost your customer retention rate. So keep a close eye on these deal risks and manage them strategically to drive your sales success.

Frequently Asked Questions

What's stopping you from turning every conversation into actionable insights?